Date: November 18, 2019

First published in Business Times on 16 November 2019

Quick Read

- Investors should take an active interest in stocks or bonds in their portfolio even if they might consider themselves passive investors.

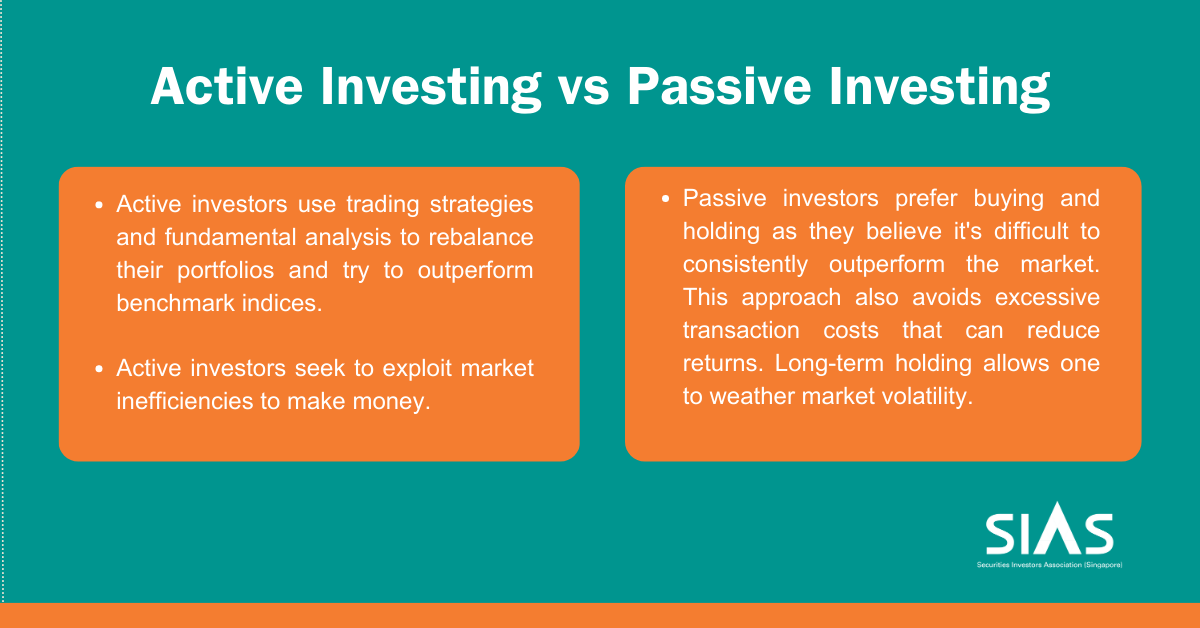

- Active investors apply trading strategies or fundamental analysis to regularly rebalance their portfolios while passive investors believe buying and holding is the better way.

- Many fund managers and individuals employ a combination of active and passive investing.

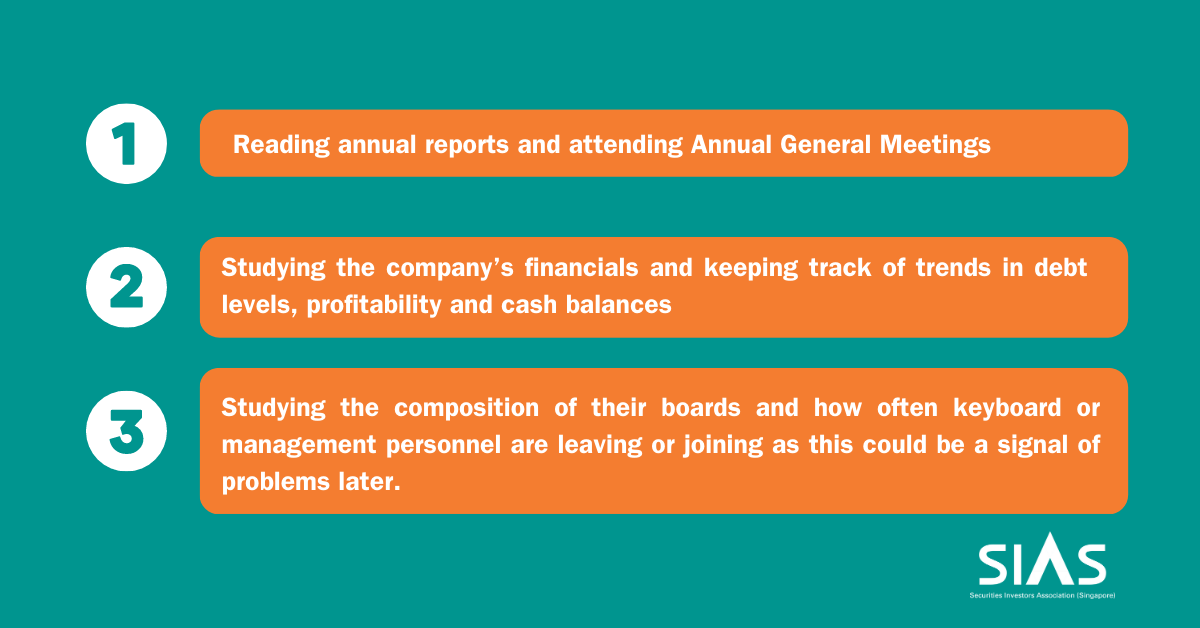

- Investors should monitor their investments by reading annual reports and keeping track of changes in business strategy, debt levels, profitability, and cash balances.

- Attend annual general meetings and familiarize yourself with questions prepared by financial analysts to ask relevant questions.

Investors should monitor their investments, keep abreast of company developments by reading annual reports and choose products that suit their risk profile.

ONE of the topics in October’s World Investor Week’s public seminars, at which the Securities Investors Association (Singapore), or Sias, was a participant, was “Active versus Passive” Investing.

During the panel discussion, one important point emerged – that although investment strategies might be broadly categorised into active or passive, there is a need for everyone who has money in the market to take an active interest in stocks or bonds in their portfolio even if they might consider themselves to be passive investors. In other words, everyone should be active investors, the only difference being one of degree.

The distinction between active and passive investing is simple

These approaches are not mutually exclusive. Many fund managers and individuals employ a combination of active and passive investing, perhaps reserving a portion of their portfolios for buy and hold instruments whilst using another portion for active trading and investing.

The problem is that in our experience, many investors are too inactive when it comes to monitoring their investments, especially those that are performing poorly. For example, there is a tendency to avoid looking at a stock that has fallen sharply and a reluctance to sell at depressed price, a mental phenomenon that behavioural economists call “loss aversion”.

A good way to stay on top of developments in a company is to read the annual report carefully and decide whether to stay or exit the company. Areas to look out for are like operating profitability and changes in business strategy.

This is not confined to only those instances involving loss aversion – in our experience, many retail investors do not pay sufficient attention to the latest developments surrounding the companies they have bought into, that is, they do not track the financials and boardroom changes which can give an early heads-up on problems ahead. Neither do they keep track of corporate developments such as proposed rights issues, major acquisitions, partnerships and new ventures.

This passivity – or apathy – leads to many individuals being caught unprepared when trouble strikes, either in the form of the company suddenly announcing that it cannot pay its debts and may be wound up, or auditors issuing qualified opinions, or when the authorities move in to investigate financial and accounting irregularities.

Another example is where the passive investor’s risk profile has changed over time. I am aware of one case where the individual complained about the recent losses in his investment-linked insurance product (ILP) due to the changes in the market conditions.

It was obvious that when this investor’s risk profile changed, he should have switched to a different fund within his ILP to better suit his current risk profile.

Whatever the crisis that descends on companies, trading in the shares concerned is typically suspended, which means shareholders cannot exit and liquidate their holdings. What then ensues is a prolonged period of uncertainty and anxiety before the issues behind the suspension are resolved, a period that can stretch to several years.

In many cases, it has to be said that once the authorities get involved, the chances of recouping a significant proportion of one’s investments are very slim. Recall for example, the case of China stocks listed here, popularly known as “S-chips”, many of which were suspended for many years before being wound up. In such cases ordinary shareholders, who rank last when companies are liquidated, receive nothing.

To avoid being caught in such an unfortunate position, Sias strongly recommends all investors actively monitor their investments by:

To assist shareholders who wish to attend the AGMs but might think they lack the necessary expertise to ask relevant questions, Sias every year sends several hundred companies a list of questions to answer that relates to their strategies, financials and corporate governance.

These questions are prepared by a team of experienced financial analysts and are sent to companies for the latter to answer ahead of their AGMs. Even if no answers are forthcoming, shareholders can familiarise themselves with the questions and then raise them at the AGM.

As long as the issues raised are to do with a company’s business, management is obliged to answer them. Shareholders should know this and therefore prepare themselves accordingly.

It is also worth noting that it is important to observe some decorum when asking questions at an AGM or even an EGM (extraordinary general meeting). Sias has prepared a guide on the proper behaviour that should be observed at company meetings, but shareholders should know that the basics are relatively simple and straightforward.

For example, shareholders should be polite and avoid use of inflammatory, abusive and insulting language; they should ensure their questions are relevant, that is, they pertain to the company’s performance over the past year; they should not dominate the question-and-answer session by asking too many questions.

- The writer is David Gerald, Founder, President and CEO of the Securities Investors Association (Singapore)