Page 93 - Demo

P. 93

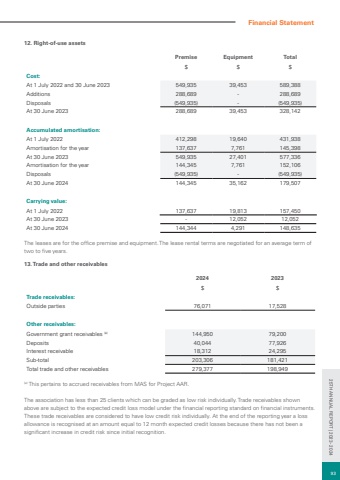

Premise Equipment Total$ $ $Cost:At 1 July 2022 and 30 June 2023 549,935 39,453 589,388Additions 288,689 - 288,689Disposals (549,935) - (549,935)At 30 June 2023 288,689 39,453 328,142Accumulated amortisation:At 1 July 2022 412,298 19,640 431,938Amortisation for the year 137,637 7,761 145,398At 30 June 2023 549,935 27,401 577,336Amortisation for the year 144,345 7,761 152,106Disposals (549,935) - (549,935)At 30 June 2024 144,345 35,162 179,507Carrying value:At 1 July 2022 137,637 19,813 157,450At 30 June 2023 - 12,052 12,052At 30 June 2024 144,344 4,291 148,63512. Right-of-use assetsThe leases are for the office premise and equipment. The lease rental terms are negotiated for an average term of two to five years.2024 2023$ $Trade receivables:Outside parties 76,071 17,528Other receivables:Government grant receivables (a) 144,950 79,200Deposits 40,044 77,926Interest receivable 18,312 24,295Sub-total 203,306 181,421Total trade and other receivables 279,377 198,94913. Trade and other receivables(a) This pertains to accrued receivables from MAS for Project AAR.The association has less than 25 clients which can be graded as low risk individually. Trade receivables shown above are subject to the expected credit loss model under the financial reporting standard on financial instruments. These trade receivables are considered to have low credit risk individually. At the end of the reporting year a loss allowance is recognised at an amount equal to 12 month expected credit losses because there has not been a significant increase in credit risk since initial recognition.Financial Statement93 25TH ANNUAL REPORT | 2023 - 2024