Page 94 - Demo

P. 94

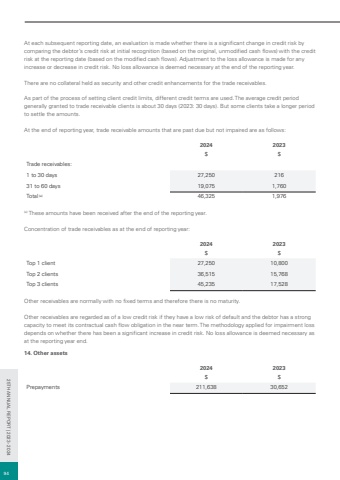

At each subsequent reporting date, an evaluation is made whether there is a significant change in credit risk by comparing the debtor%u2019s credit risk at initial recognition (based on the original, unmodified cash flows) with the credit risk at the reporting date (based on the modified cash flows). Adjustment to the loss allowance is made for any increase or decrease in credit risk. No loss allowance is deemed necessary at the end of the reporting year.There are no collateral held as security and other credit enhancements for the trade receivables.As part of the process of setting client credit limits, different credit terms are used. The average credit period generally granted to trade receivable clients is about 30 days (2023: 30 days). But some clients take a longer period to settle the amounts.At the end of reporting year, trade receivable amounts that are past due but not impaired are as follows:2024 2023$ $Trade receivables:1 to 30 days 27,250 21631 to 60 days 19,075 1,760Total (a) 46,325 1,976(a) These amounts have been received after the end of the reporting year.Concentration of trade receivables as at the end of reporting year:2024 2023$ $Top 1 client 27,250 10,800Top 2 clients 36,515 15,768Top 3 clients 45,235 17,528Other receivables are normally with no fixed terms and therefore there is no maturity.Other receivables are regarded as of a low credit risk if they have a low risk of default and the debtor has a strong capacity to meet its contractual cash flow obligation in the near term. The methodology applied for impairment loss depends on whether there has been a significant increase in credit risk. No loss allowance is deemed necessary as at the reporting year end.14. Other assets2024 2023$ $Prepayments 211,638 30,6529425TH ANNUAL REPORT | 2023 - 2024