Date: November 17, 2020

In the financial world, bonds are generally considered to be relatively safer investments than stocks for two reasons.

First, in the event that the issuer runs into financial problems and has to be wound up, bond holders will be paid before ordinary shareholders.

Second, bond issuers, whether companies or governments, are usually obliged to pay regular interest, usually every six months, and when the bond reaches maturity, the investor is repaid the original principal.

Because of the regular, fixed payments of bonds, in general, they are described as “fixed income’’ instruments and usually form the basis of portfolios where a regular stream of income is necessary to the investor.

However, it is important to appreciate that all bonds are not completely safe, and that every single one comes with some level of risk. We will deal with the risks later but for now, the questions to consider are: given that bonds are generally considered safer than stocks, what proportion of a portfolio should comprise of bonds and how does one choose suitable bonds from the wide range available?

Define your investment objectives

The starting point in the selection process is to have a clear understanding of what investment objectives are to be achieved. Broadly speaking, investment objectives can be separated into three categories which are loosely related to the individual’s age and stage of life.

These objectives are Growth, Income and Security and whichever is desired will influence the type and proportions of investments in the portfolio. In the following discussion the basic idea will be that as an individual ages and approaches retirement, his or her portfolio should be rebalanced gradually to become more conservative, with less invested in risky assets like equities and more in safer assets like bonds.

Growth and the investment horizon

At a younger age of say 21-35 years, individuals are said to have a lengthy investment horizon ahead of them. This means they have plenty of time, perhaps around 30-40 years, to not just invest but also remain in employment and therefore continue earning income that can help recoup or cushion any investment losses they may suffer during their investment journey.

As such, they are said to be able to take on more risk and therefore invest for growth. This means their portfolios can include a greater proportion of equities relative to other assets because studies have shown that over longer periods of time starting at about 12 years, stocks can deliver superior returns despite undergoing frequent bouts of short- and medium-term volatility.

For investors in this age group, one suggested portfolio composition would be 70% stocks, 20% bonds and 10% cash, ie weighted in favour of equities but with some money invested in bonds.

Income

As individuals progress in their careers into their 40s and early 50s, their investment horizon starts to shorten which means they should gradually reduce their exposure to risky assets and shift some money into more conservative investments.

They are also entering the peak of their careers and are enjoying perhaps their greatest earning capacity, but at the same time they have to start thinking about retirement, which may be only 5-10 years in the future.

What all this means is that they should rebalance their portfolios to include a greater proportion of bonds relative to stocks. One suggested division would be 40% equities, 40% bonds and 20% cash.

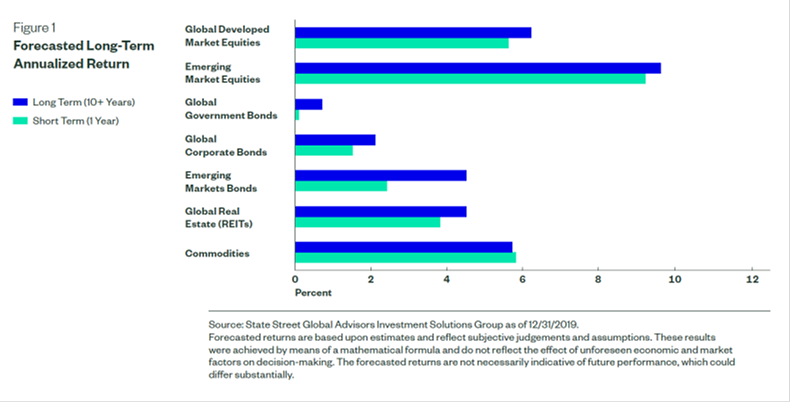

Such a mix is sometimes referred to as a “balanced’’ portfolio because of the equal proportions in stocks and bonds. In this case, the bonds should be of slightly better quality than those held earlier – the returns may be lower, but so would the risk. Please find the forecasted long-term annualised returns of the various asset classes below.

Security

As the investor moves into the pre-retirement and then retirement stages at age 60 and above, his or her investment horizon would now be very short, so the priority must be to preserve the hard-earned capital built up over the years as there is very little time employment time left.

Ideally, the portfolio of older investors at these life stages should be very conservative. However, the investments chosen should not just ensure capital is preserved but should also generate some income to help meet the investor’s retirement income needs.

This means that a portfolio that aims for security should be heavily tilted towards very safe bonds, ie those which carry very little risk. A suggested composition for such a portfolio would be 50% bonds, 30% equities and 20% cash. In addition, the equities should ideally be safer blue chips, preferably those which have stable businesses and pay good dividends.