Date: May 5, 2025

What will happen to Sinarmas Land shareholders after the Voluntary Unconditional Cash Offer?

It is almost a year since SIAS’ last press statement that many Voluntary Unconditional Cash Offers have created a dilemma for Minority Shareholders because they are not given a choice to make a fair decision due to the poor terms of offers. One year later, we are still on the same topic.

Many shareholders have expressed unhappiness on the recent Voluntary Unconditional Cash Offer made for Sinarmas Land which is widely seen to be “lowball’’ and therefore exploitative. SIAS shares their view.

First, SIAS notes that the offer has been deemed “not fair but reasonable’’ by the independent financial adviser (IFA) whose opinion was released on 25th April 2025, two days after the announcement that the free float had fallen below 10%1, in which case trading may soon be automatically suspended on SGX.

Second, SIAS notes that as at 31 Dec 2024, the net asset value (NAV) per share of Sinarmas Land was about S$0.85, which means that the offer is pitched at a significant 63.6% discount to NAV.

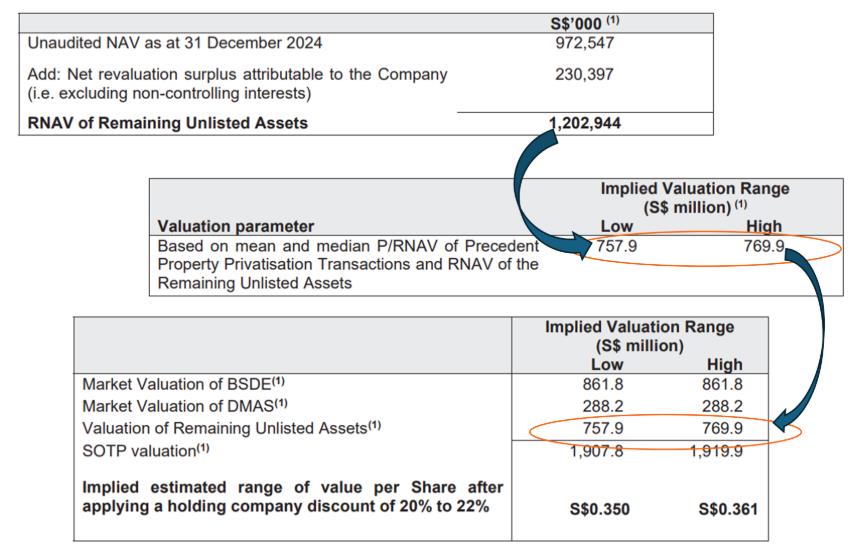

Third, the IFA’s opinion that the offer is “not fair’’ is based on, amongst others, its assessment of fair value of S$0.35 to S$0.361 per share which takes into account the market value of Sinarmas’s stakes in listed subsidiaries PT Bumi Serpong Damai Tbk (BSDE), PT Duradelta Lestari TBK (DMAS) and its remaining unlisted assets.

However, SIAS would highlight to shareholders that the IFA assumed a “holding company discount’’ of 20-22% when arriving at the above figures, an assumption which can be questioned.

What is particularly concerning in the IFA report is that Sinarmas Land’s remaining assets, carried at $972.5 million on the balance sheet and revalued to $1.2 billion, were valued at only $757.9 million in the Sum-of-the-Parts (SOTP) analysis. The IFA applied a discount of 37% to the revalued NAV of these assets before applying a further holding company discount. In our judicial system, appeal mechanisms are a fundamental safeguard—yet in the takeover process, there appears to be no recourse for minority shareholders to challenge the IFA’s conclusions, no matter how debatable. We contend that the unlisted assets have effectively been double-discounted in the SOTP analysis. Removing the discounts could increase the fair value by as much as 10.5 cents per share.

All things considered, SIAS therefore strongly disagrees with the IFA’s advice and the independent directors’s recommendation which was for shareholders to accept the offer. Instead, SIAS calls upon the offeror to make a revised offer that is fair, reasonable and closer to the NAV per share of $0.851. By so doing, this would avoid a potentially prolonged suspension which would severely disadvantage minorities.

As far as the minorities are concerned, they have to decide whether to cash out at a perceived “lowball’’ offer of S$0.31 per share by 14 May 2025 or hold on to their shares for an extended period once trading suspension takes place and hope for further announcements from Sinarmas Land with regards to a revised offer, if any. The offeror has stated that it does not intend to preserve the listing status of the company and does not intend to support or take any step to restore its free float. If the offeror is entitled to exercise its rights to compulsory acquisition under Section 215(1) of the Companies Act, it will do so.

Should shareholders decide that waiting is their preferred option, they need to have sufficient holding power and understand that there is no assurance that any future exit offer will exceed the current one.

Nevertheless, minority shareholders can take some comfort in knowing that the current listing rules require any delisting offer to be both “fair and reasonable” and approved by 75% of independent shareholders present at the Company’s EGM.

David Gerald

Founder, President and CEO

SIAS

1 It is puzzling that shareholders holding 936,270,312 shares, representing approximately 22% of the total issued shares of the company, accepted the offer even before the release of the IFA opinion and the recommendation of independent directors, especially when the market price has been higher than the offer price since the offer announcement. Given that the free float was only 29.62%, the valid acceptance of 74% is striking. The most recently published shareholding statistics showed no other substantial shareholder apart from entities related to the Widjaja family.

Subscribe to Newsletter

Subscribe to SIAS Mailing List and get updates to all upcoming events and news

By clicking submit, you agree to our privacy statement, collection, use and/or disclosure of your personal data to the extent necessary to provide you with this service.