Date: August 18, 2015

SIAS is concerned with the trading activity of CEFC International shares which has been issued with a “Trade with Caution” advisory by SGX on 21 Jul 2015.

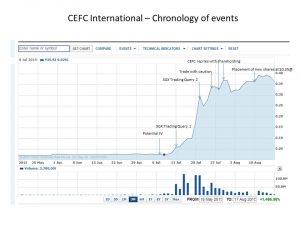

SIAS is aware that on 7 Jul 2015, CEFC disclosed that they were in discussions with potential joint ventures to acquire equity interest in a company that currently owns a floating storage tank. The company announced that no binding agreement had been entered at that moment.

Subsequently, SGX queried the company regarding its trading activity on 13 Jul 2015, of which, CEFC responded that besides the previously announced discussions on its potential joint ventures on 7 Jul 2015, whether it was aware of any information not previously announced by the company, that could explain the trading.

SGX, yet again, queried CEFC regarding its trading activity on 21 Jul 2015. The company responded by referring to the previous announcements of 7 and 13 Jul and disclosed that CEFC was internally evaluating fund raising options which may include a loan from a controlling shareholder. It highlighted that there was no certainty that neither the potential joint ventures nor the funding would materialise. The company again responded that it was not aware of any information not previously announced by the company that could explain the trading. As a result of the inability to account for the trading activity, SGX issued a “Trade with Caution” on CEFC shares on 21 Jul 2015. When the “Trade with Caution” notice was issued, the share price of CEFC had already risen from 2.5 cents on 7 Jul 2015 to 29.5 cents on 21 Jul 2015.

In view of the unusual trading activity of CEFC shares, which prompted the SGX queries, CEFC disclosed the shareholding statistics and the percentage of shareholdings held in public hands as of 24 Jul 2015, which was released on 29 Jul 2015. CEFC subsequently announced on 10 Aug 2015, that it had agreed to place 705,530,975 new ordinary shares at an issue price of $0.35 per share. On 14 August, SGX further reiterated its trade with caution on CEFC shares and highlighted that only a small number of offshore accounts accounted for 40% of the recent buying of CEFC shares. The persistent and nature of queries by SGX is a good development for the investors and the market. SIAS sees this development as a good benchmark for companies which may be in a similar predicament.

Retail investors need to also note that the shares of CEFC had risen from 2.5 cents on 7 Jul to an intraday high of 40.5 cents on 14 Aug 2015 without any fundamental change in the company’s business. This should have been a concern or a red flag for the investors.

SIAS welcomes the action by SGX to provide a timely caution to trading of CEFC shares, in the absence of reasons for the unusual trading pattern, and the disclosure that 40% of the recent buying had been confined to a small number of offshore accounts. These disclosures aim to provide more transparency on the trading of CEFC shares and help provide more information to the investors. These disclosures by SGX help promote corporate governance and investor confidence. Hence, SIAS welcomes this move. SIAS also calls on CEFC, as its duty, to communicate its business strategy and fundamentals to all its investors to enable them to make an informed decision.

David Gerald

Founder, President & CEO

Securities Investors Association (Singapore)

Chart Source: Yahoo Finance