Date: November 8, 2023

- SCSA will be spotlighting corporate sustainability practices that encapsulate both quantitative and qualitative indicators of success

- The new SCSA Award scorecard and methodology are driven by investor-centrism and a holistic sustainability lens, in collaboration with NUS-CGS and its industry partners

- 4 Big-Caps, 2 Mid-Caps, 2 Small-Caps, and 2 REITs and Business Trust emerge as top winners for this new Award

- Overall, 46 corporates and 12 individuals emerged as Winners for over 70 awards at ICA

- ICA to recognise winners from this year as part of inclusivity and stringency of judging criteria

- SIAS members who are shareholders of the listed companies get to vote for the Investors’ Choice Outstanding CEO Award and Best Retail Broker Award for the first time

SINGAPORE, 8 NOVEMBER 2023 – Securities Investors Association (Singapore) (“SIAS”), a strong advocate for corporate transparency and progressive industry practices aimed at protecting shareholder interests, has launched the Singapore Corporate Sustainability Award (SCSA) at this year’s Investors’ Choice Awards (“ICA”) 2023 ceremony.

ELEVATING INVESTOR-CENTRIC SUSTAINABILITY GOVERNANCE PRACTICES

The new Award was announced by Guest-of-Honour, Ms Grace Fu, Minister for Sustainability and the Environment at ICA 2023. SCSA will be an annual award, presented in four categories to Big-caps, Mid-caps, Small-caps, and REITs & Business Trusts. These four categories will provide SIAS the opportunity to recognise the diversity of organisations and companies that make up Singapore’s dynamic business landscape and demonstrate excellence in making actionable change.

Nominations were reviewed through a two-tier process, first through the STEMS framework, followed by the Refinitiv scorecard (refer to Annex A for the areas of assessment). The judging committee, comprising the research team from NUS Centre for Governance & Sustainability (CGS) and an independent selection of committee members from professional bodies and media, then tabulated their scores based on quantitative and qualitative assessments respectively to determine the winner.

Mr David Gerald, Founder, President & CEO, SIAS, said, “Incorporating robust sustainability frameworks into corporate business models has emerged as the hallmark of success. Addressing the biggest challenge of our era of climate change has propelled sustainability to the forefront, with investors increasingly prioritising sustainable practices throughout supply chains.

“Recognising the fragility of supply chains, the integration of sustainability into corporate operations confers an array of advantages, including risk mitigation, operational efficiencies, and diminished costs. The implementation of a successful sustainability strategy, however, is not without its share of challenges; there remains a need for corporations to strike a balance between the interests of key stakeholders and shareholders, all the while steering toward enduring impact.”

“Now, it is important to accord due recognition to outstanding corporate entities that have integrated sustainability into the different facets of their business models, spanning foundational processes to stringent reporting standards. The Singapore Corporate Sustainability Award is dedicated to spotlighting corporate sustainability practices that encapsulate both quantitative and qualitative indicators of success.”

Together with NUS-CGS and its industry partners, the enhanced scorecard and methodology of this new Award focus on sustainability, with an eye on a holistic Singapore which is investor-centric. Singapore investors are increasingly focused on knowing the types of ESG risks companies are exposed to, their plans to manage those risks, and how they are meeting their sustainability targets. This is reflected in the more comprehensive methodology that encompasses sustainability, governance, transparency, and communications in listed companies for the benefit of investors.

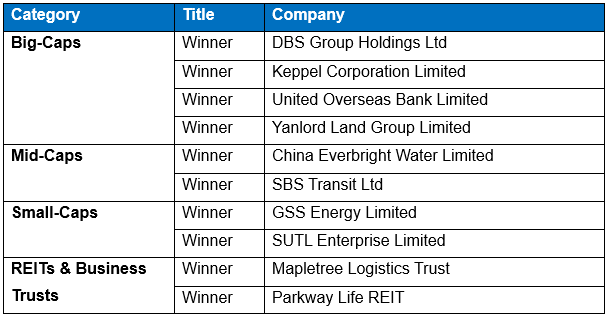

For the Big-Caps, Mid-Caps, Small-Caps, and REITs & Business Trust categories respectively, the following companies emerged as winners for the new SCSA.

46 CORPORATES EMERGE AS WINNERS FOR ICA’S 75 AWARDS

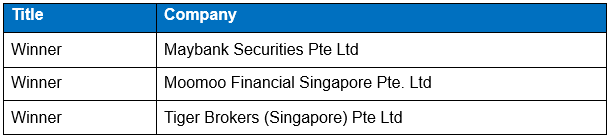

At ICA 2023, 12 individuals and 46 corporates clinched the winners’ title from seven awards categories including the Singapore Corporate Governance Award, Singapore Corporate Sustainability Award, Investors’ Choice Outstanding CEO Award, Shareholder Communications Excellence Award, Financial Journalist Award, Best Retail Broker Award and Most Transparent Company Award (refer to Annex B for full list of winners).

Notably, SIAS is also driving its focus on setting the industry standard of excellence in the work done by listed companies by limiting each category to only the winners. This is reflective of ICA’s inclusivity and stringency of the judging criteria. Another new introduction for the ICA awards is that shareholders have been included in voting for the Outstanding CEO Award and Best Retail Broker Award, for the first time. Please refer to our ICA website at https://sias.org.sg/corporate-governance-week/awards/.

The average overall Singapore Corporate Governance (SCG) scores continued its upward trend and reached 60.5% in 2023 over a six-year period from 2018. In terms of sustainability, there remains room for improvement among these listed companies in Singapore for its climate-related disclosures. Please refer to the Key Research Findings for 2023 at Annex C.

ICA 2023 is part of the SIAS Corporate Governance Week (CGW) 2023, held from 6 – 10 November. The week-long event provides an invaluable opportunity to gain insights from industry experts, thought leaders and global executives as they share the latest trends in Corporate Governance across the corporate and charity sectors.

CGW2023 is also supported and endorsed by many professional and trade bodies, as well as leading institutions and corporations, including:

Supporting Exchange

- Singapore Exchange (SGX)

Supporting Organisations

- Association of Banks in Singapore (ABS)

- Accounting and Corporate Regulatory Authority (ACRA)

- SGListCos

Endorsers

- Association of Chartered Certified Accountants (ACCA)

- CFA Society Singapore

- Chartered Secretaries Institute of Singapore (CSIS)

- CPA Australia

- Financial Markets Association of Singapore (FMAS)

- Institute of Singapore Chartered Accountants (ISCA)

- Investment Management Association of Singapore (IMAS)

- Securities Association of Singapore (SAS)

- The Institute of Internal Auditors Singapore (IIA)

The official media is The Business Times and the official IR consultancy is Citigate Dewe Rogerson.

About SIAS

SIAS actively promotes good corporate governance and transparency practices, investor rights, investor education and is the watchdog for investors in Singapore. SIAS rates companies on their governance practices together with industry partners and rewards companies excelling in good corporate governance practices.

SIAS, the largest organised investor group in Asia, is run by an elected Management Committee comprising professionals who are volunteers. It is now a registered Charity and an Institution of Public Character.

In addition to its focus on corporate governance, SIAS extensively provides a variety of investor education programmes to its members and the investing community at large through collaborative arrangements with financial institutions and listed companies interested in investor education as part of their corporate social responsibility agenda.

For more information about SIAS, please visit www.sias.org.sg.

| ISSUED ON BEHALF OF | : | Securities Investors Association (Singapore) (“SIAS”) |

| BY | : | Citigate Dewe Rogerson Singapore Pte Ltd |

| 158 Cecil Street #05-01 Singapore 069545 |

||

| CONTACT | : | Ms Dolores Phua / Mr Teo Zheng Long |

| DURING OFFICE HOURS | : | 6589-2383 / 6589 2389 |

| : | dolores.phua@citigatedewerogerson.com | |

| zhenglong.teo@citigatedewerogerson.com |

ANNEX A

The STEM scores include 5 areas of assessment:

- Strategy and Governance

- Target and Metrics

- Environment and Climate

- Materiality and Stakeholders

- Social and Organisation

The Refinitiv stock scores include 5 components-quantitative assessments:

- Earnings

- Fundamentals

- Relative Valuation

- Risk

- Price Momentum

ANNEX B

SIAS INVESTORS’ CHOICE AWARDS

WINNERS’ LIST 2023

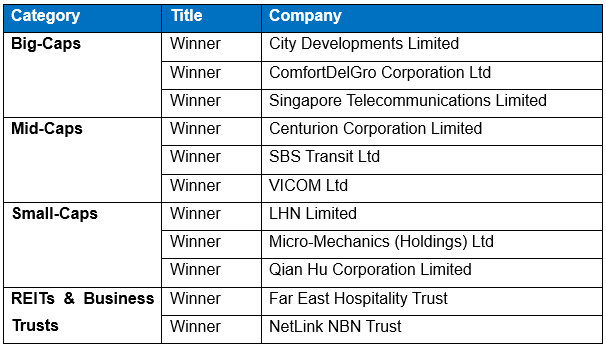

SINGAPORE CORPORATE GOVERNANCE AWARD

SINGAPORE CORPORATE SUSTAINABILITY AWARD

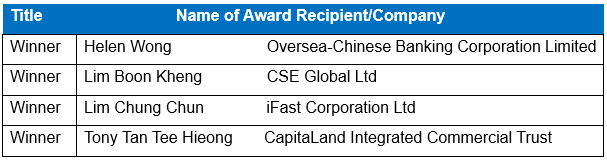

INVESTORS’ CHOICE OUTSTANDING CEO AWARD

SHAREHOLDER COMMUNICATIONS EXCELLENCE AWARD

FINANCIAL JOURNALIST AWARD

BEST RETAIL BROKER AWARD

MOST TRANSPARENT COMPANY AWARD